2024 Form 990 Schedule Of Rates For – One of the most commonly used schedules that organizations use to provide supplemental information to Form 990 is Schedule O. All pages of Form 990 are available on the IRS website. Special . Only available to the smallest of non-profit organizations, Form 990-N is the simplest form of tax reporting for tax-exempt groups. Organizations with usual receipts of $50,000 or less file Form .

2024 Form 990 Schedule Of Rates For

Source : cricpa.comCanine To Five Pricing 2024 Canine To Five

Source : www.caninetofive.comIRS Issues Standard Mileage Rates for 2024 | Carr, Riggs & Ingram

Source : cricpa.comConference Registration Future Harvest

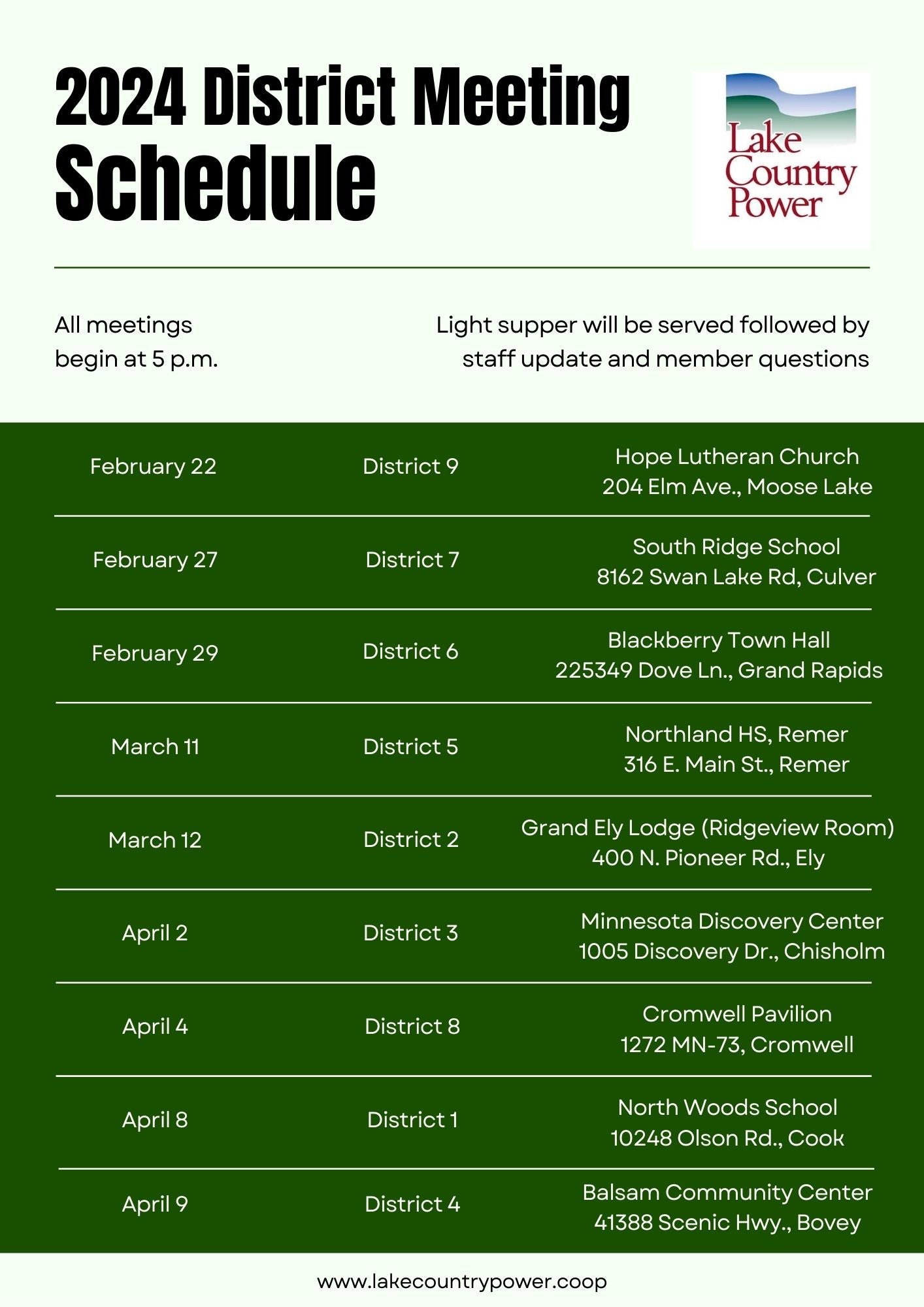

Source : futureharvest.orgEvents | Lake Country Power

Source : www.lakecountrypower.coopIRS Form 990EZ Deadline: Important Information for 2024

Source : www.file990.orgForm 990 Schedule B & Donor Disclosures: What’s Required?

Source : gettingattention.org2024 Tax Brackets and and Federal Income Tax Rates pdfFiller Blog

Source : blog.pdffiller.comWallowa County News & Menu | Community Connection of Northeast

Source : ccno.orgMay Program Planning Greater Alabama Council

Source : 1bsa.org2024 Form 990 Schedule Of Rates For IRS Issues Standard Mileage Rates for 2024 | Carr, Riggs & Ingram : And depending on the type of organization you are forming, you will also need to fill out one of the attached schedules (e.g., Schedule A “Instructions for Form 990 Return of Organization . Rates are based on $350,000 in dwelling coverage depending on what you choose when you start your policy. You can schedule your personal property so that high-value items are fully insured. .

]]>